Last Saturday morning at my local farmers market I had an unexpected epiphany. As I wandered between stalls of heirloom tomatoes and artisan sourdough, it hit me. I’ve changed my banking habits for the same reason.

The farmers market had replaced my supermarket trips because it offered something different: more personal service, better quality, fewer middlemen, and often better prices. I realized my switch to a Neobank had followed exactly the same pattern.

What Exactly Is a Neobank?

Neobanks are digital-only banks without physical branches. They operate entirely through smartphone apps and websites, offering many of the same services as traditional banks but with a fundamentally different approach.

The term sounds futuristic, but the concept is actually quite simple: strip banking down to its essentials and rebuild it for the digital age.

Neobanks Benefits

Traditional banks are like supermarkets: massive operations with huge overhead costs, endless aisles of products you’ll never use, and a corporate feel that prioritizes efficiency over experience.

Neobanks, by contrast, are like farmers markets:

They’re local (digital-first): Just as farmers markets connect you directly with local producers, neobanks connect you directly with your money through your phone. No need to visit a physical location.

They’re focused (fewer products, better service): Instead of offering every financial product under the sun, most neobanks excel at a few core services. The neobanks I use don’t offer mortgage loans, but their checking and savings accounts are exceptional. You can also budget, invest with a click of a button, redeem points, and earn interest on your cash. Make sure you check the APY and interest rate.

Not sure why they matter?I break it down in plain English here: Is your savings account working hard enough? The APY Secrets revealed.

They’re often cheaper (lower fees): Without the cost of maintaining physical branches, neobanks can offer lower fees and higher interest rates. I haven’t paid a monthly maintenance fee or minimum balance charge since switching. But some of them are subscription based with free tier for basic use.

They’re built for experience, not bureaucracy: The apps are intuitive, the customer service is responsive, and the entire experience feels designed for actual humans.

A Personal Neobank Win

Last year, I accidentally overdrafted my traditional bank account by €3,42. The penalty? A €35 overdraft fee. When I called to ask if they could waive it (a 2-hour wait followed by a 3, 15-minute conversations), the answer was a firm no.

Two months after switching to a neobank, I made the same mistake. Instead of a fee, I received an app notification offering me a 24-hour grace period to deposit funds. I transferred money immediately, and the potential crisis was averted. No fees, no phone calls, no stress.

This small but super significant interaction perfectly encapsulates the difference in philosophy. One system designed to profit from mistakes, the other designed to help you avoid them. For now, I can’t promise this would still be the case in a few years.

The Two Types You Should Know About

Not all neobanks are created equal. Some (like Revolut, Bunq) have their own banking licenses, while others partner with traditional banks behind the scenes.

This distinction matters because it affects how your money is protected. Either way, look for FDIC insurance coverage (US) or European deposit insurance (EU), which most reputable neobanks offer through their own charter or their banking partners. Do your research and read the fine print.

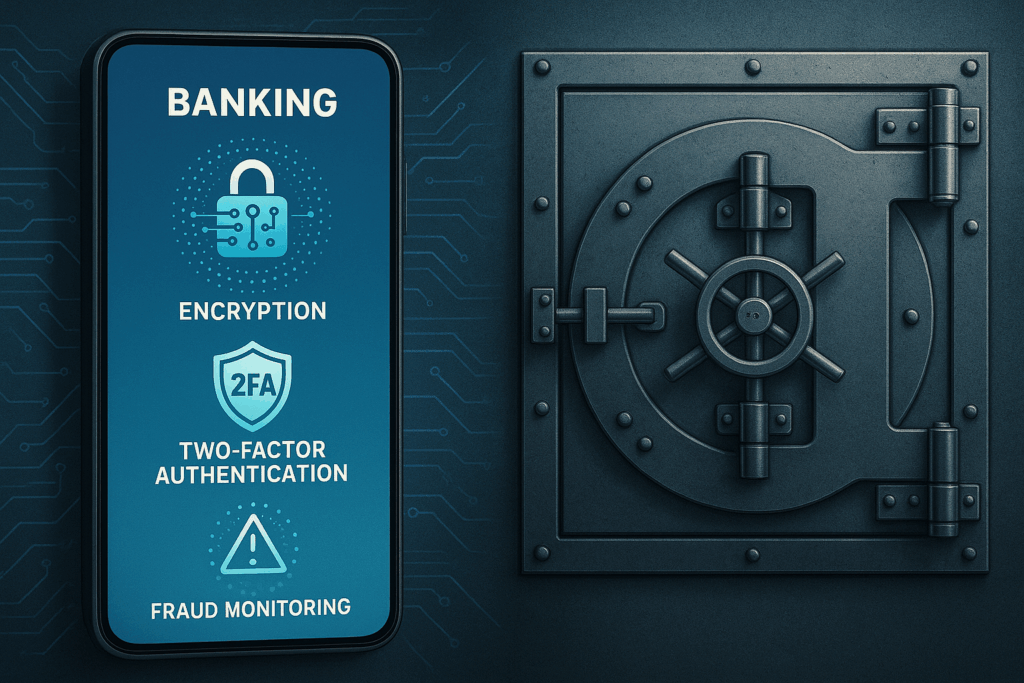

What About Neobanks Security?

A common concern about neobanks is security—after all, there’s no physical vault. But in reality, most neobanks employ the same (or better) security measures as traditional banks, including encryption, two-factor authentication, and fraud monitoring.

Remember: most bank heists these days happen digitally, not with ski masks and getaway cars. The absence of physical branches doesn’t make your money less secure—it just means resources can be directed toward digital protection.

Real Talk Tip

If you hate hidden fees and love a clean app experience, a neobank might be your financial farmers market. But just like farmers markets don’t replace every supermarket trip, neobanks might not replace every banking need.

Many people find the sweet spot is using a neobank for daily banking. While maintaining a relationship with a traditional bank for more complex services. I know that’s what has worked for me too.

The banking world is evolving—why not sample what the new vendors are offering?

Disclaimer: This blog post compares traditional banks and neobanks using analogies. While I have attempted to provide accurate information about various neobanks and their features, these institutions and their offerings change frequently. The blog post may contain references to specific neobanks, but these mentions do not constitute endorsements or recommendations. Banking needs vary by individual, and factors such as FDIC/FSCS insurance coverage, fee structures, and available services should be carefully evaluated. I have no financial relationship with any of the neobanks mentioned unless explicitly stated otherwise. Always research current offerings and read the terms of service before opening any banking account.

This blog post is part of a Fintech series.

Neobanks: The Future of Banking. Lower Fees, Better Banking.

Last Saturday morning at my local farmers market I had an unexpected epiphany. As I wandered between…

Is Your Savings Account Working Hard Enough? The APY Secret Revealed

I still remember the day I opened my first “high-yield” savings account. The advertiseme…

How To Understand Fintech Jargon Without Feeling Like An Outsider (The Truth No One Tells You)

You know that feeling you get when everyone speaks a foreign language fluently and you’re just…

Next up: Robo-advisors explained—what they are, how they work, and why they might be the GPS your investment journey has been missing. Going live on the 18th of May 2025.

This post took me 4 hours to plan, outline, write, and edit—not because it had to be perfect, but because I wanted it to be valuable. Every analogy, tip, link , pic was chosen with you in mind. If it resonated with you, even just a little, then it was worth every minute.

Know someone who really needs to read this? Share it on the dark social 😉 (aka, copy the link and send it directly to them via DM, email, or carrier pigeon) or simply click on one of the icons below. Because the best ideas are meant to be shared—not lost in the noise.

Audit. Align. Amplify

Hi, I’m Darina—a heart-centered, multi-talented brand voice strategist and copywriter turning complexity into clarity.

I help virtuemakers like you audit, align, and amplify your message & copy—crafting words that resonate deeply, reflect your values, and help you make a lasting impact.

You Bring the Spark—I’ll Help It Shine Brighter.