Who’s Behind These Words (And Why You Can Trust Me)

Heyyy I’m Darina,

For more than 20 years, I invested in experiences—not stocks.

I was the person booking flights instead of buying funds, collecting moments instead of assets. But even then, I lived below my means, saved diligently, and understood how to stretch a euro (or a dollar) without stretching my soul.

Two years ago, something shifted.

I decided it was time to invest in my future the same way I had invested in memories. I dove headfirst into learning about money, fintech, and building real, sustainable wealth—without selling out my values.

I’m not here to preach. I’m here to translate. To make money talk less confusing, more human, and a lot less intimidating.

Because if you can plan a backpacking trip across Europe, you can absolutely learn how compounding interest works.

Welcome to the Fintech Jargon Explained your no-BS guide to getting smarter (and kinder) with your money.

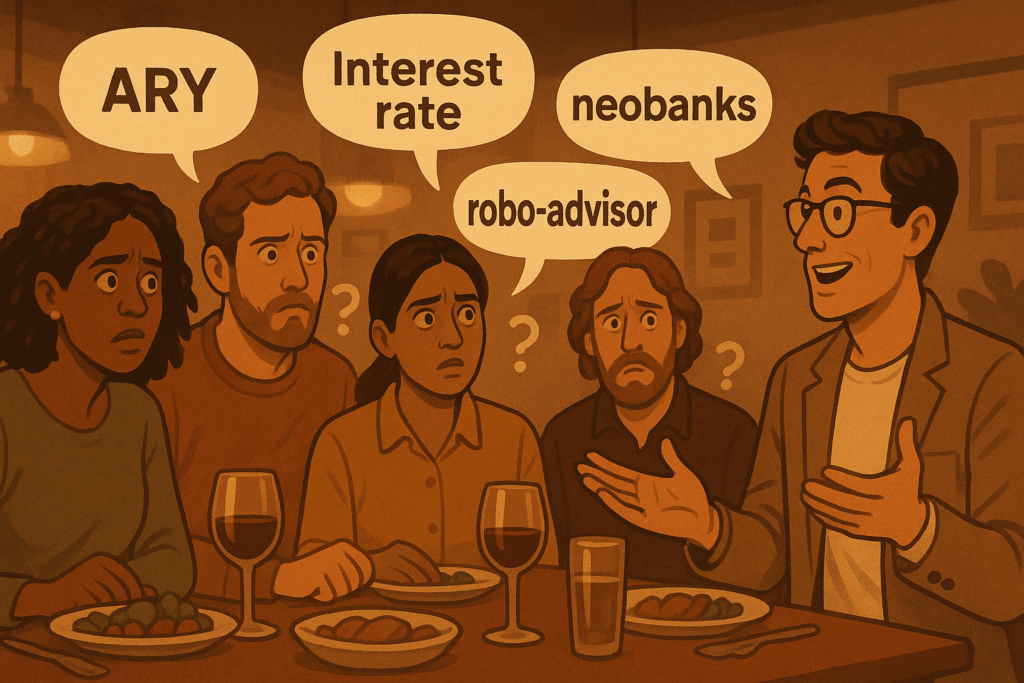

You know that feeling you get when everyone speaks a foreign language fluently and you’re just lost. That’s how it felt the first time I opened a fintech app. I felt like I’d landed in a foreign country where everyone spoke fluent fintech except me.

There I was, staring at terms like “APY,” “blockchain,” and “robo-advisor” while everyone around me nodded knowingly. It was like being at a dinner party where everyone discussed quantum physics while I was still trying to remember basic algebra.

I remember specifically looking at a high-yield savings account advertisement boasting a “3.5% APY with daily compounding” and thinking, “Is that good? Bad? Average? Should I be impressed?” The psychological barrier wasn’t just understanding the terms—it was the fear of looking foolish by asking. And this is coming from a copywriter who makes a living from asking the right questions.

The Struggle Is Universally Real

When I mention this experience to friends, their eyes light up. That moment of “I thought I was the only one who didn’t get it!” breaks through.

Here’s the truth that financial companies don’t want you to know: fintech terminology isn’t designed for clarity. It’s designed to make simple concepts sound sophisticated.

The banking industry has spent decades wrapping straightforward ideas in complex language. Why say “your money grows” when you can say “compounding interest accrues on your principal”? Honestly, I’ll take the first one any day.

Fintech Jargon Are Just Tools, Not Tests

I’ve come to realize that fintech terms are just kitchen gadgets. You don’t need to understand every function of your blender to make a smoothie. You just need to know which button to press.

Similarly, you don’t need to understand the blockchain’s distributed ledger technology to use a payment app. You just need to know it works.

This revelation changed everything for me. Instead of feeling intimidated by financial jargon, I started seeing it as what it really is: tools designed to help us manage money more effectively. And let’s be honest, we all desperately need to manage $$$ better.

Your Fintech Translation Awaits

Over the next few blog posts, I’ll explain the most common fintech terms into plain English, using everyday analogies that actually make sense. Think of it as Fintech Jargon Explained kind of series.

We’ll explore:

The financial world doesn’t have to feel foreign. Consider this your personal translation guide to the language of modern money (in that order).

- Why your APY is actually like a coffee that keeps getting topped up.

- How neobanks are the farmers markets of the banking world.

- Why robo-advisors function like a GPS for your money.

- How blockchain works like a neighborhood potluck (yes, really).

Take the first step today: Next time you encounter a financial term you don’t understand, don’t skip over it. Write it down and comment it below, I promise we’ll cover it in this series. I’ve come to realize that financial literacy isn’t about knowing everything—it’s about being willing to learn one term at a time.

Next blog posts in the series go live on the 4th, 11th, 18th, 25th of May 2025.

Stay tuned.

Meanwhile, why don’t you follow me on social?

Disclaimer: This blog post aims to simplify complex financial technology concepts through analogies and explanations. While efforts have been made to ensure accuracy, financial terminology and concepts may have specific legal and technical meanings that differ from the simplified explanations provided here. The analogies used are meant to aid understanding and should not be interpreted as precise technical definitions. Financial literacy is an ongoing journey, and readers are encouraged to seek additional resources and professional guidance for a comprehensive understanding of fintech concepts.

This post took me 3 hours to plan, outline, write, and edit—not because it had to be perfect, but because I wanted it to be valuable. I chose every analogy, tip, pic with you in mind. If it resonated with you, even just a little, then it was worth every minute.

Know someone who really needs to read this? Share it on the dark social 😉 (aka, copy the link and send it directly to them via DM, email, or carrier pigeon) or simply click on one of the icons below. Plus, you get some street cred when you spread ideas worth sharing. A win-win, no?

Neobanks: The Future of Banking. Lower Fees, Better Banking.

Last Saturday morning at my local farmers market I had an unexpected epiphany. As I wandered between…

Is Your Savings Account Working Hard Enough? The APY Secret Revealed

I still remember the day I opened my first “high-yield” savings account. The advertiseme…

How To Understand Fintech Jargon Without Feeling Like An Outsider (The Truth No One Tells You)

You know that feeling you get when everyone speaks a foreign language fluently and you’re just…

Need messages that reflect your mission, inspire trust, and Foster meaningful connections?

Here is how I can support you..

1. Feeling stuck? Ensure Your Brand is on the Right Track & Gain Peace of Mind with Strategic Guidance. Let’s dive into your brand’s challenges and find clear, actionable paths forward.

2. Build a resilient brand with Holistic Brand Voice Guide—forge a message that stands strong, even in challenging times.

3. Want to Set your Brand up for Success? Check out my Complete Brand Communication Strategy —a comprehensive plan to engage your audience and drive growth.

4. Pick the level of support you need: from Brand Strategy, and Human–Centric Copywriting to Optimization & Consulting Services.

Let’s tailor a solution that resonates with you and your audience.

Strategic, Strong, & Stable Foundation.

Holistic Brand Strategy

Lay the foundation for a brand that stands out and speaks to the right people.

Words that Engage, Persuade, & Drive action.

Human-Centric Copywriting

Get messages that speak to your audience, sing to their souls, creating lasting bonds and genuine conversations.

Boost Your Results

Optimization & Consulting

Refine, improve, and ensure your brand is on the right track.